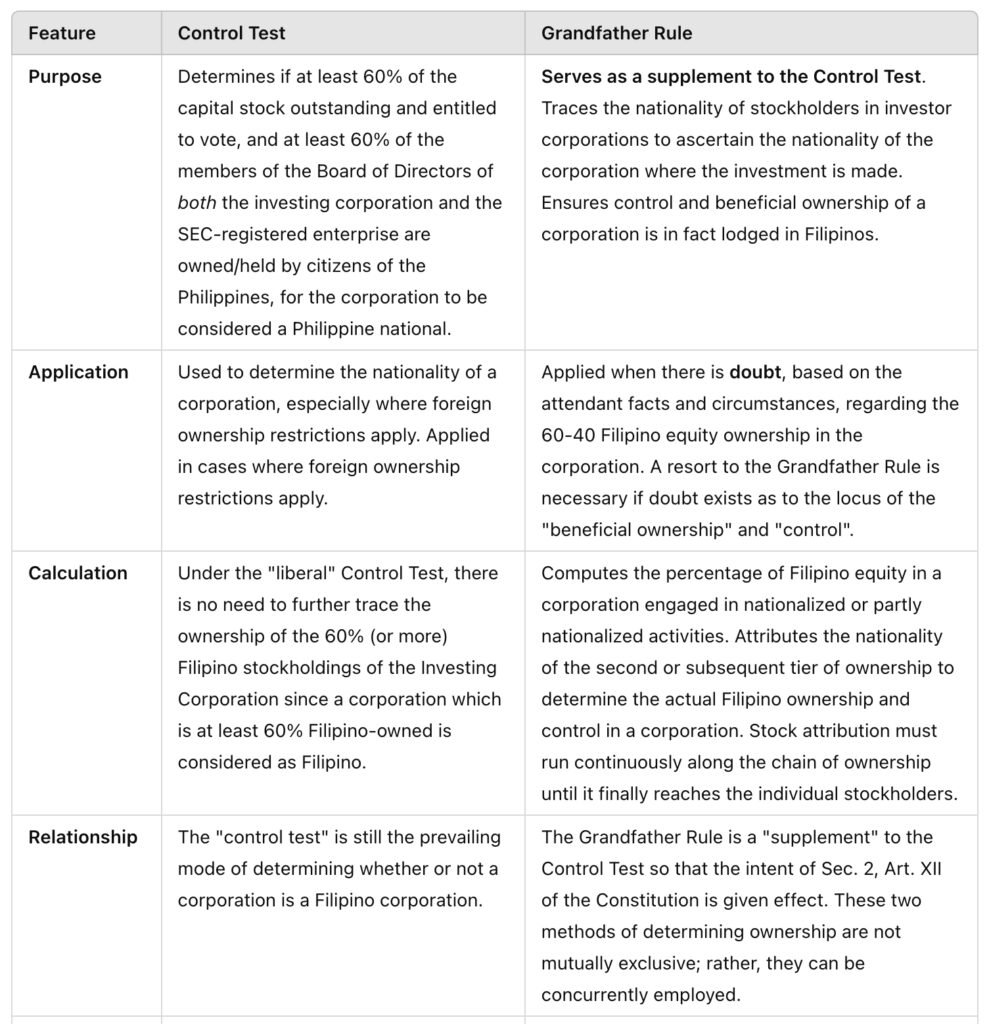

The Grandfather Rule is used to determine the nationality of a corporation, especially when foreign ownership restrictions apply. It serves as a supplement to the Control Test to ensure the intent of the constitutional provision limiting foreign equity is upheld.

Here’s a breakdown of the Grandfather Rule:

- Purpose: To trace the nationality of the stockholder of investor corporations to determine the nationality of the corporation where the investment is made.

- Application: The Grandfather Rule is applied when there is doubt, based on the facts and circumstances, regarding the 60-40 Filipino equity ownership in a corporation.

- Calculation: It computes the percentage of Filipino equity in a corporation engaged in nationalized or partly nationalized activities by attributing the nationality of the second or subsequent tier of ownership to determine actual Filipino ownership and control. In multi-tiered corporations, stock attribution follows the chain of ownership until individual stockholders are reached.

- Control Test vs. Grandfather Rule: The Control Test is generally used to determine the nationality of a corporation. However, when there’s doubt about beneficial ownership and control, the Grandfather Rule is applied. These tests are not mutually exclusive and can be used together to check compliance with foreign ownership restrictions.

- SEC Guidelines: The Securities and Exchange Commission (SEC) has suggested applying the Grandfather Rule on two levels of corporate relations for publicly-held corporations or where shares are traded on the stock exchanges, and three levels for closely-held corporations or those whose shares are not traded on stock exchanges.

- Beneficial Ownership: A resort to the Grandfather Rule is necessary if doubt exists as to the locus of the “beneficial ownership” and “control”.

- Conditions for Application:

- The corporation is engaged in nationalized or partly nationalized activities.

- Stockholders include corporations. *Illustrative Example:

- Corporation A and Corporation B have equal interest in Corporation C.

- A is 60% owned by Filipinos, while B is 50% owned by Filipinos.

- Applying the Grandfather Rule, A has 30% Filipino interest in C (60% of 50%), and B has 25% Filipino interest in C (50% of 50%).

- The total Filipino interest in C is 55% (30% + 25%). *The grandfather rule is applied in the following cases:

- Under the Grandfather Rule Proper, if the percentage of Filipino ownership in the corporation or partnership is less than 60%, only the number of shares corresponding to such percentage shall be counted as of Philippine nationality.

- Under the Strict Rule or Grandfather Rule Proper, the combined totals in the Investing Corporation and the Investee Corporation, when traced (i.e., “grandfathered”) to determine the total percentage of Filipino ownership, show less than 60% requirement.

- If based on records, Filipinos own at least 60% of the investing corporation but there is doubt as to where control and beneficial ownership in the corporation really reside.

- Nationalized activities are economic sectors where ownership, control, or participation is limited to Filipino citizens or entities with significant Filipino equity. These restrictions aim to preserve national interest, ensure public welfare, and promote economic independence.

- Some examples of nationalized activities include those listed on the Foreign Investment Negative List (FINL), which has two components:

- List A enumerates activities reserved to Philippine nationals by the Constitution and specific laws. Examples include mass media, practice of professions, retail trade enterprises with less than ₱25 million capitalization, small-scale mining, utilization of marine resources, and ownership of lands.

- List B contains activities and enterprises regulated pursuant to law, where foreign equity is limited in industries or activities that may affect public safety, morals, and national security. Restrictions apply to entities involved in critical infrastructure, such as power distribution, water services, and railways, as well as defense-related activities and those with implications on public health and morals.

- Partially nationalized activities allow up to 40% foreign ownership. These include:

- Public Utilities: Require at least 60% Filipino equity.

- Exploration and Utilization of Natural Resources: Foreign participation is limited to 40% under financial or technical agreements with the government.

- Education: Educational institutions (except those established by religious or mission groups) must be at least 60% Filipino-owned.

- Advertising: Companies engaged in advertising must have at least 70% Filipino ownership.