This is a case that answers the question: “Do our tribes get an equitable share from mining activities?”

In this case, the defendant is one of the biggest mining firms in the world. The plaintiff is a very small tribe on the island of Mindanao, Philippines.

When giant mining corporations enter the country, set-up mining sites, hire people, and excavate, how do our laws ensure that all interests are protected? How can we balance the ROI interests of the mining corp while protecting our environment from irreversible damages from mining, protecting our communities, and miners’ jobs? Moreover, what are the safeguards or consolations to tribes which may be displaced? How much do they receive? Does our Constitution allow it?

This case tries to answer these questions.

Facts of the Case:

Sections 289 to 292 (LGC) of the Local Government Code provides for the share of the Local Government from exploration, development, and utilization (EDU) of national wealth.

The Petitioners

La Bugal B’laan Tribal Association, Inc., (The Tribe)

- One of the counsels for the tribe was the current Justice Marvic Leonen

- Location: Southern Mindanao

- History of Displacement

Defendants

- DENR Secretary Victor Ramos

- MGB-DENR Director

- Executive Secretary

- FTAA Contractor: WMC (Philippines) Inc.

Thesis Statement: The Tribe assails the constitutionality of the Philippine Mining Act (RA 7942) and the DENR IRR (DAO 96-40) on 7 grounds. (2nd of 7 Grounds: Violation of Article III of 1987 Consti.)

Tribe: “Philippine Mining Act is Unlawful Deprivation of Property”

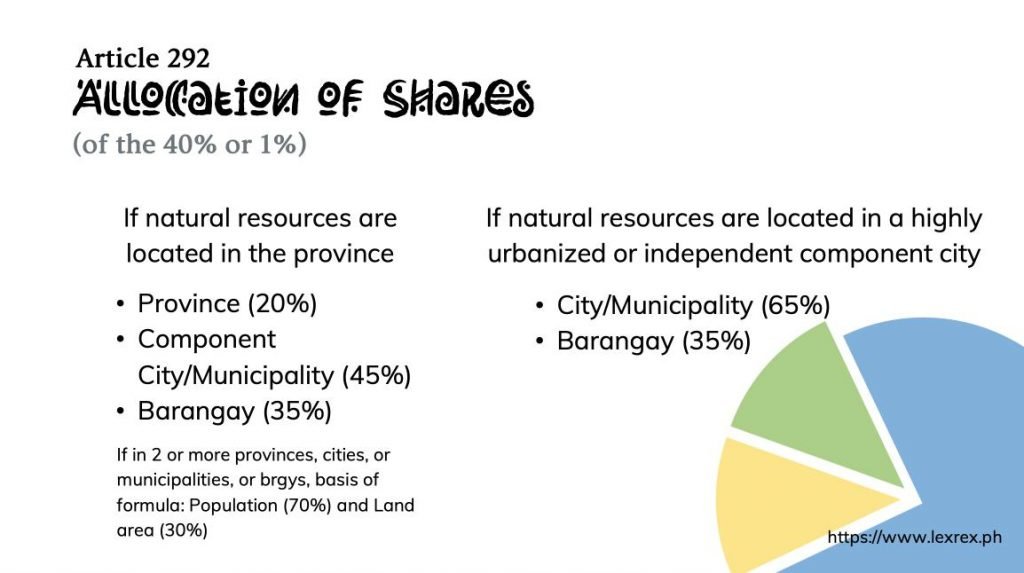

“Equitable Share” – “The Local Government Units (LGUs) shall have equitable share in the proceeds derived from utilization and development of national wealth within their respective areas, including indirect benefits for inhabitants.” (Article 289)

Article 290: “40% of Gross Collection” – If development and utilization of national wealth is done within their territorial jurisdiction… “in addition to internal revenue allotment, LGUs shall receive 40%of gross collection derived by national government from preceding fiscal year…

Article 291: “1% of Gross Sales or 40% of collection” – If development and utilization of national wealth is done by government agency or GOCC (Government-Owned or Controlled Corporation), LGU shall receive (a) 1% of gross sales or calendar year; or (b) 40% of taxes, royalty, charges, fees, fines collected by the gov. agency or GOCC, whichever is higher.

2 Decisions in this case:

- January 2004: (GR No. 127882)

- December 2004: (GR No. 127882)

1st decision. Tribe: The law, IRR, and agreement are unconstitutional because they allow foreign corporations to the EEDU of our natural resources contrary to State’s “full control”. Court: Granted (some parts of Ph Mining Law unconstitutional). Respondents appealed.

December 2004 Decision: Court: “the (IRR)… ensures equitable sharing of the benefits derived from mineral resources.”

IRR: Government’s financial benefits are called here as: “Government Share”

- Basic Government Share

- Additional Government Share

Basic Government Share

- Payment to National Government

- Payment to Local Governments

- $Local Business Tax – 2% of gross sales

- $Real Property Tax – 2% of fair market value of property

- $Special Ed. Levy – 1% of basis of real property tax

- $Occupation Fees – P50/hectare per year or P100/ha if in mineral reservation

- $Community Tax – Max of P10,500 per year

- $All other local government taxes and fees, rates depend on LGUs

- Other payments:

- $Royalty to indigenous cultural communities if any = 1% of gross output of mining operations;

- $Special allowance = payment to claim owners and surface rights holders

Additional Government Share

- Source: Section 81 of Philippine Mining Act

- In addition to income tax, excise tax, special allowance, witholding tax from dividends or interest payments, all other duties and fees by laws

- Contractor has 3 options based on DAO 99-56:

(1) Fifty-fifty sharing in the cumulative present value of cash flows;

(2) Share based on excess profits

(3) Sharing based on cumulative net mining revenue - Proceeds from FTAA contract shall be distributed in the following proportions:

- National Government: 50%

- Provincial Government: 10%

- Municipal Government: 20%

- Affected Barangays: 20%

“More Advantageous” – Court: “We believe the FTAA is a more advantageous proposition for the government as compared with other agreements permitted by the Constitution like CPA, JVA, and MPSA.”

LGC (279 to 282) vs. FTAA under DAO

Court’s Other Reasons

(1) Using verbal legis, there is absence of express provisions signaling the demise of service contracts, no transitory provisions;

(2) In the Constitution, when we say “involving”, it means there are other parts included in the agreement;

(3) The drafters of our Constitution were economists and businessmen also. They know that when you invest your money, you want to make sure that it will succeed and not go to waste. Foreign corporations want to ensure that their Billions are properly managed;

(4) Service contracts were not evil per se, they are still in the 1987 Constitution but with Safeguards such as (a) it will be in accordance with law; (b) President shall sign; (c) Report it to Congress.

Final Ruling: Tribe’s Petition Dismissed

- Ph Mining Act constitutional

- IRR constitutional

- FTAA with WMCP valid except 7.8 and 7.9 which are contrary to public policy and grossly disadvantageous to the government.